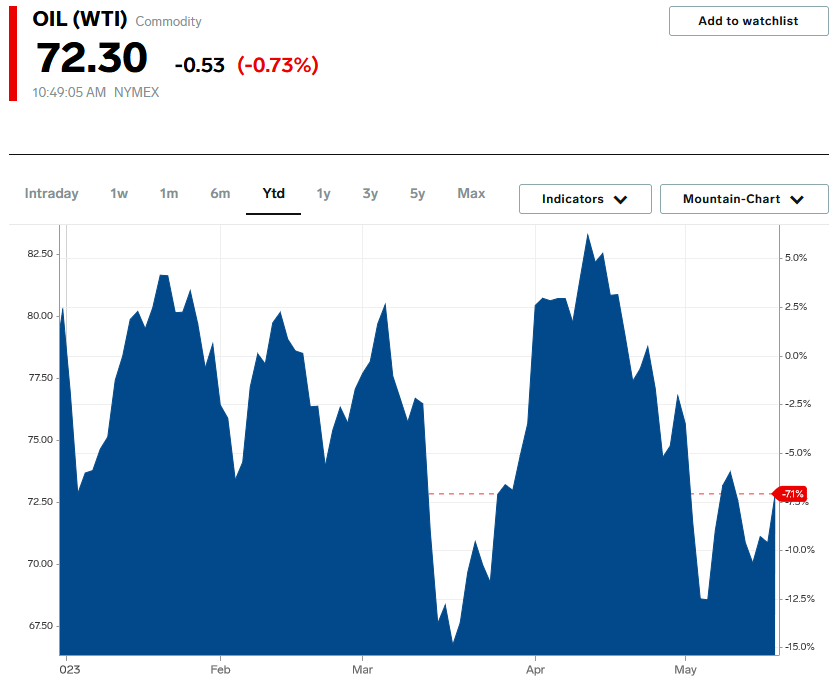

Over the past several months, we have seen crude oil decline in price in stark contrast to several other things in the market. Indeed, West Texas Intermediate crude oil is down 7.10% year-to-date:

This is in stark contrast to the stock and bond markets, which have both shown surprising strength this year. This is unsurprising though, since the market strength is being driven by expectations that the Federal Reserve will soon pivot and cut interest rates. The fact that inflation, as indicated by the consumer price index, appears to be weakening is often cited as support for this view. However, as I pointed out previously on this blog, the declining headline inflation rate is being caused by weakness in crude oil and natural gas prices. Thus, the situation may not be as clear-cut as analysts appear to think because the second the Federal Reserve pivots, energy prices will take off and drive headline inflation right back up into the stratosphere!

Oil Sell-Off May Be Foolish

As I pointed out in a recent post, the Organization of Petroleum Exporting Countries announced in the middle of April that it would begin reducing crude oil production. This correctly caused crude oil prices to spike upward in anticipation of lesser supply. However, all those price gains have since been erased by the market:

This is despite the fact that the production of crude oil will decline by one million barrels per day over the May 2023 to December 2023 period. As Tsvetana Paraskova at OilPrice.com points out,

Concerns about the U.S. economy, another build in U.S. inventories, and signs of a patchy economic recovery in China have weighed on the petroleum complex this week, overshadowing signals that the United States could begin buying crude soon to fill the Strategic Petroleum Reserve.

In other words, the weakness in crude oil prices is being caused by fears that the United States economy may soon be about to enter a recession that drags down oil demand. This is a reasonable fear, and indeed I have stated numerous times that I expect to see a recession by the end of this year. Thus, this is a reasonable concern.

Potential Crude Oil Shortage

The International Energy Agency has a different take on things. Earlier this week, the agency released a report that made a few very important observations. The most important of these is that the agency is projecting that worldwide demand for crude oil will increase by 2.2 million barrels per day in 2023. This is because China’s economic recovery from the COVID-19 lockdowns is proceeding much more rapidly than was believed last month. In March, China’s crude oil demand set a new record and it is reasonable to assume that it increased further in April.

Thus, barring a pretty severe recession in the United States, it appears likely that a global shortage of crude oil will likely emerge later this year. The economic law of supply and demand states that this should push energy prices up. That would prove to be a major headwind in the Federal Reserve’s fight against inflation and could even force it to raise interest rates more than it has already done. This would undoubtedly have a very negative effect on the market later this year.