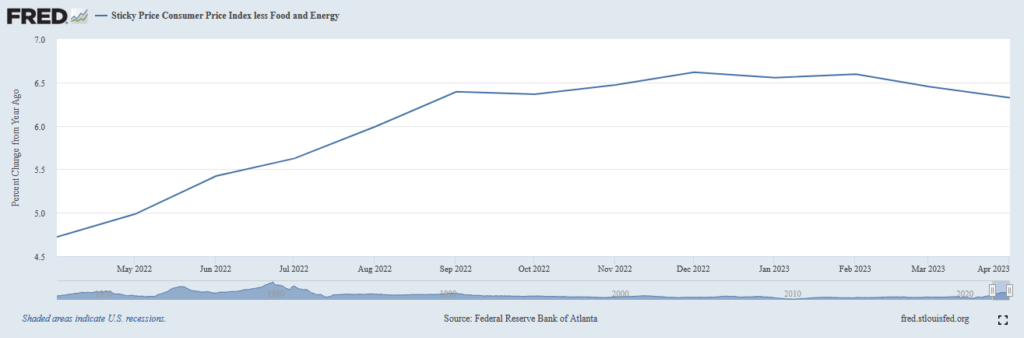

In multiple previous posts on this blog, I have shown evidence that the American consumer is in dire straits. This is at least partly due to inflation, which has been running at more than 4% for two years now:

This would not be a problem if wage growth was keeping up with the rapidly-rising cost of living. However, this is not the case as shown by the Federal Reserve data:

As we can clearly see, real wages have generally been falling since the middle of 2020, although we have seen a very slight improvement over the past two quarters. This explains why Americans seem to be complaining less about high fuel costs. After all, as I explained a few weeks ago, falling crude oil and natural gas prices have been the biggest reason behind the falling headline inflation that has occurred since the start of the year. This is clearly shown here, as the core consumer price index, which excludes food and energy prices, has not shown the same decline that we have seen in the headline numbers:

Thus, the only conclusion that we can derive from this is that consumers are being financially stretched in a serious way. This is something that investors need to consider when determining where to put their money, as it is much easier for consumers to cut back on discretionary spending than on necessities such as food and energy.

Rising Consumer Debt

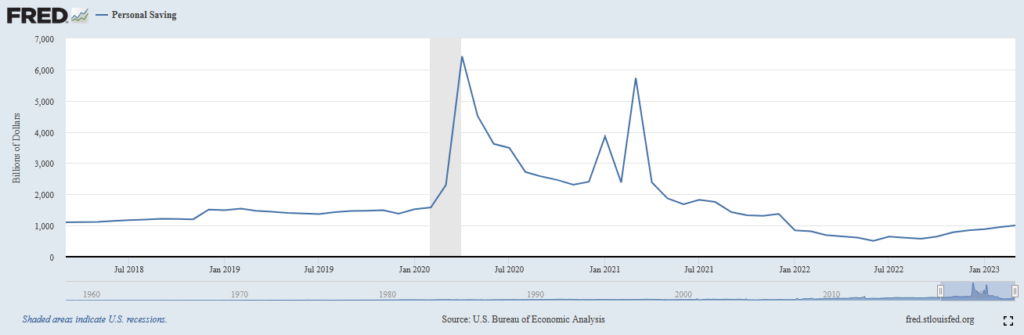

There have been a few ways in which consumers have responded to the rising prices and stagnant real wages. After all, American consumers do not want to give up their “toys” and luxuries unless they are left with no choice. One of the ways in which Americans have been trying to maintain their lifestyles is by spending down their personal savings, which were accumulated as a result of various government handouts and stimulus packages during the COVID-19 pandemic. The Federal Reserve currently puts Americans’ combined personal household savings balances at $1.0019 trillion, which is lower than the $1.3723 trillion that Americans had saved back in December 2021:

Admittedly, we have seen the numbers start to improve since the middle of last year. That was, not coincidentally, around the same time that crude oil prices started to decline, which took some pressure off when someone fills up their car. However, despite this improvement, American savings balances are still lower than they were in the years preceding the pandemic. In fact, in March 2018, which is the lowest level for personal savings in the past five years excluding the inflationary period of 2022, American personal savings were at $1.1053 trillion. As the prices of most goods and services were significantly lower around that time, we can conclude that real personal savings were much higher relative to today than the data states (the above data is not adjusted for inflation).

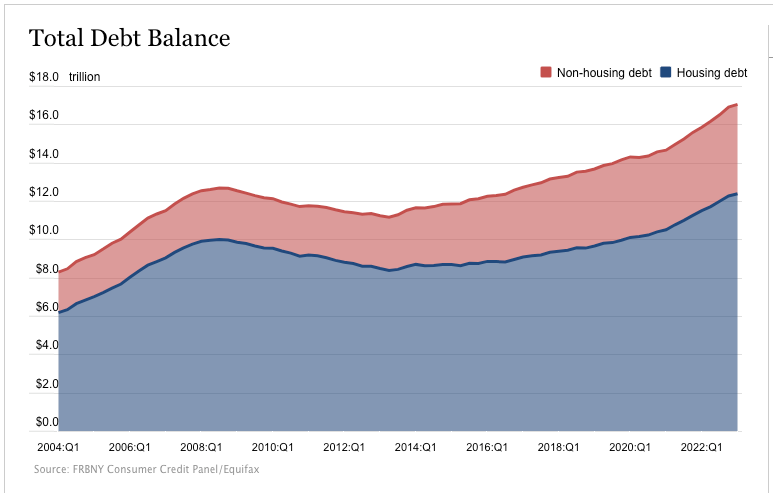

Another way in which consumers have attempted to maintain their lifestyles in the face of rising prices and stagnant wages is by going further and further into debt. At the end of March 2023, total consumer debt passed $17 trillion for the first time in history.

This represents a $2.9 trillion increase since 2019 despite the fact that revolving credit card balances dropped substantially during the pandemic. It also represents a break in the usual pattern, which is that revolving debt typically declines during the first quarter as consumers pay down the credit card balances that they accumulated during their holiday spending sprees. This is, therefore, a clear sign that consumers are hurting since it likely indicates that they are actually going into debt to purchase necessities, as opposed to luxuries.

Consumer-Focused Companies Reporting Weakness

Further evidence that consumers are going into debt just to pay for necessities comes from none other than Scott Feiler, a consumer-focused trader at Goldman Sachs. Mr. Feiler reports that four companies missed expectations recently and cited weakness in consumer spending.

From Mr. Feiler’s report:

- Lowes (LOW): Put up a -4.3% comp vs consensus -3.4% and a bogey for a -4%. Blamed weather but also spoke to softer-than-expected demand for discretionary purchases and a slowdown in DIY spending.

- AutoZone (AZO): In one of the more surprising misses, they did a +1.9% comp vs consensus +4% and a bogey of +5%. Said weaker than expected sales in March meaningfully impacted the quarter. Will see what they say on the call about if/how much trends picked back up after March.

- BJ’s Wholesale Club (BJ): Comp sales of +5.7% vs consensus +6.1% and a bogey for +6%. Not the end of the world they missed by 40 bps on comps and 200 bps on total sales, but it was their largest sales miss in 10 quarters. This is the most debated name in my IB’s this morning with clients, with a lot of bulls (margin upside) and bears (comp miss, disinflation theme).

- DICK’S Sporting Goods (DKS): 1Q comps of +3.4% missed consensus by 40 bps. They did say they continue to gain share and the stock has moved lower into the print on some softer end of quarter checks (away), but we think a modest comp beat was expected, not a miss.

At this point, some readers may point out that only Lowes actually saw a sales decline. However, remember that inflation has been running by much more than these companies’ comparable sales figures increased. Thus, they almost certainly saw a decrease in the actual number of goods sold and only made up for it with the fact that prices were higher. That is very much a sign of a weakening consumer in the aggregate, as it indicated that some people are now opting out of the marketplace due to budgetary pressures.

Takeaway

In conclusion, we are continuing to see signs that the American consumer is weakening. There is a limit to how much indebtedness they can take on before collapsing, so we cannot depend on that to maintain spending levels long-term. As there are signs that energy prices may reverse their downward trend, the potential discretionary spending collapse could be closer than the market expects.

Disclosure: I have no positions in any stock mentioned in this article and have no intentions of entering into a position in a mentioned stock within the next 72 hours.