Earlier this year, I published an article to this site suggesting that the production cuts implemented by the Organization of Petroleum Exporting Countries could push prices up. We have been seeing that play out over the past month or two, as can be clearly seen here:

The price of West Texas Intermediate crude oil hit its year-to-date high today, although it still remains far below the levels that it had in 2022. This represents the continuation of a trend that has been ongoing since late June.

This has generally had a positive impact on most energy-related stocks. For example, the iShares U.S. Energy ETF (IYE) is up a fairly impressive 14.33% over the past three months:

This is in direct defiance of much of the rest of the market, as the S&P 500 Index (SPY) is only up 5% over the same period. The S&P 500 Index has also been a much wilder ride, as it spent much of August in free fall before rebounding around the end of the month.

There may be some reasons to assume that crude oil prices will continue to climb over the coming months.

Background

As just mentioned, much of the current strength in crude oil prices is the direct result of a decision made by the Organization of Petroleum Exporting Countries back in April. I discussed this decision in a previous article that was linked to earlier:

On April 3, 2023, the Organization of Petroleum Exporting Countries announced that it would cut production by one million barrels in May. This comes on the heels of a two million barrel per day cut announced in October of 2022. Oil prices surged following this announcement, with Brent crude oil climbing 5.3% in the first trading day following OPEC’s announcement. According to Reuters, once these cuts are imposed in May, the organization will have reduced global oil supply by 3.66 million barrels per day from the levels that we had last summer.

These cuts come as we are entering into the summer season in the northern hemisphere, which typically results in rising consumption of gasoline and other petroleum distillates. After all, the summer months are when Europeans and Americans both typically embark on pleasure travel for vacations. The added demand from this typically boosts the consumption of fuel used for this purpose. We are certainly starting to see this in the United States, as gasoline consumption was up 1.4% last week compared to the prior week and we have not yet entered the summer travel season.

Power Hedge Global

We did see a spike in crude oil prices following this announcement, but that spike quickly started to taper off. There are a few possible reasons why the production cuts did not have a lasting impact on energy prices, including:

- A general expectation that the U.S. economy would shortly enter a recession. That was reflected in the market strength during the first half of the year, which saw long-duration stocks surge as investors began to think that the Federal Reserve would adopt a more accommodating policy and cut interest rates. A recession would also reduce American demand for crude oil and offset some of the impact that the production cuts would have on the supply-demand balance.

- The Biden Administration continuing to drain the Strategic Petroleum Reserve. As I pointed out in a few articles on my private investing service (subscription required to review), the Biden Administration did not begin to refill the Strategic Petroleum Reserve last fall as it originally promised. Rather, the Administration continued to use the nation’s stockpile of reserves to try and keep the market supplied with crude oil until mid-July.

At his recent speech from Jackson Hole, Chairman Powell strongly implied that the Federal Reserve will not be cutting interest rates anytime soon, which effectively dashed the market’s optimism on the first point. With respect to the second, the Strategic Petroleum Reserve has now been depleted to the lowest level possible without jeopardizing its structural integrity. As such, the Administration can no longer use that as a tool to hold down crude oil prices.

New Developments

Earlier today, Saudi Arabia and Russia both surprised markets by stating that they have no intention of reversing the production cuts. Zero Hedge reported on this development this morning:

Just after 9am ET, Saudi Arabia said it would extend the voluntary cut of 1 million b/d for another three months, from October until the end of December, well beyond the expectation of just one more month. Saudi press agency SPA notes that the voluntary cut decision will be reviewed monthly to consider deepening the cut or increasing production. The extension of cuts is meant to reinforce the precautionary efforts made by OPEC countries with the aim of supporting the stability of the oil market. The Saudi announcement came as a shock to market as 20 out of 25 traders and analysts surveyed by Bloomberg last week had predicted the additional cutback would be continued for just one additional month.

Zero Hedge

The Russians made a parallel announcement that they would also keep their own 300,000 barrel per day production cut active until the end of the year.

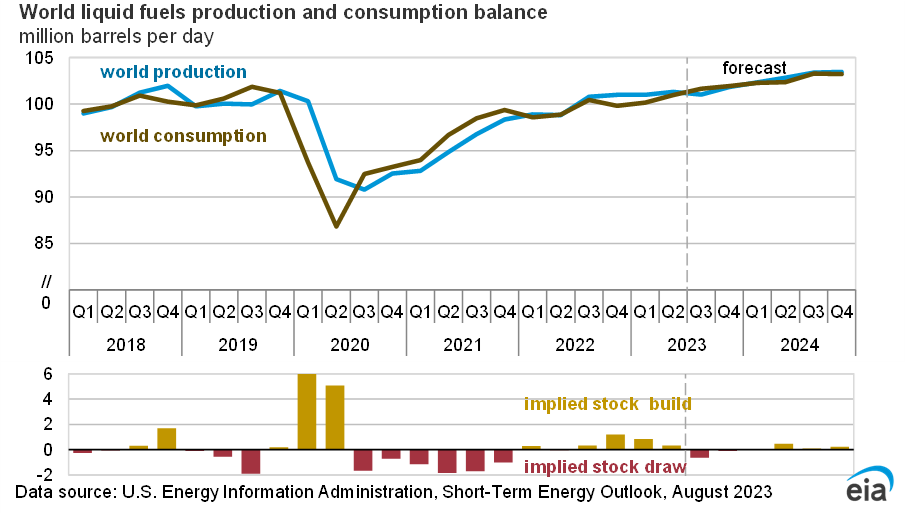

Thus, we have a situation in which crude oil prices seem likely to experience strength through the end of the year as two of the largest producers globally seem determined to keep the balance between the supply and demand of and for crude oil extremely tight. The U.S. Energy Information Administration appears to confirm this, as it is currently projecting that there will be essentially no slack in the crude oil markets through the end of 2024:

This will almost certainly result in higher energy prices going forward, as any production decline in one area will need to be made up for elsewhere or the law of supply and demand states that energy prices will surge. This is probably the outcome that the Saudi Arabians are hoping for, and they might be able to achieve it.