In various previous posts, I have discussed how American consumers seem to be struggling more than the media wants us to believe. For example, consider the following posts:

- The Jobs Data Continues To Get Worse

- Further Evidence Mounts That Casts Doubt On Employment Strength

- The U.S. Consumer Is Hitting A Brick Wall, Negatively Impacting Discretionary Stocks

- Signs Of A Worsening Jobs Market

- The U.S. Consumer Continues To Get Crushed

- Student Loans To Deliver Another Blow To Consumer Spending

- Consumers Continue To Face Considerable Financial Stress

The basic narrative here is that despite politicians touting the success of the economic recovery from the depths of the COVID-19 lockdowns, millions of average middle-class people are in a great deal of economic pain. Indeed, only a few years ago “dumpster diving” was considered something that only starving homeless people do but now we are seeing average middle-class people do it. It has become such a phenomenon that we are now seeing YouTube videos instructing people how to go through dumpsters behind restaurants or other businesses as a way to save money:

There are numerous other videos available on both YouTube and TikTok, as a simple search will reveal. I now ask you, would people really be doing this unless they were desperate to save money due to experiencing severe financial stress?

Further Evidence That Consumers Are Under Financial Stress

This post is more than a repeat of my previous reports on this topic. Over the past few days, more evidence has come out that the American people are severely stretched financially.

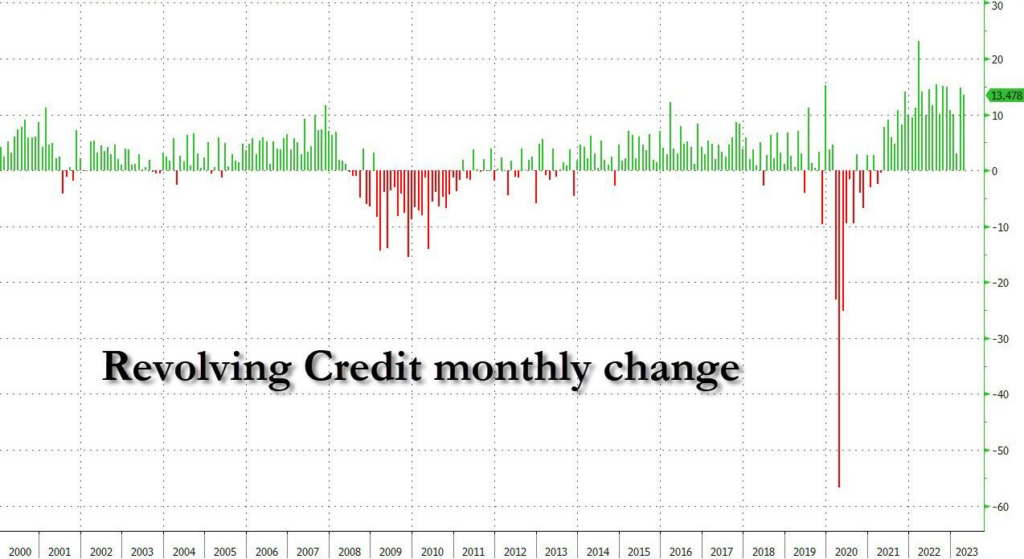

Earlier today, Zero Hedge published a statement from Synchrony Financial (SYF), which is one of the largest issuers of consumer revolving credit in the United States. According to the bank, it is closing numerous accounts and capping credit card limits. The reason for these actions is the increasing financial stress on consumers. As I mentioned in various previous blog posts and articles, one of the ways that American consumers have been maintaining their lifestyles in the face of the highest inflation that we have seen in decades is by borrowing money. As we can see here, credit card debt increased during the last few months of 2022 and every month in 2023:

This situation is obviously concerning Synchrony Financial, otherwise, it would not be cutting off customers from taking on more debt. This will undoubtedly ripple throughout the economy, as consumers will have less ability to spend on discretionary items and will be forced to cut back on things such as dining out in restaurants, staying at hotels, and purchasing various technological gadgets.

We are also seeing consumers starting to cut back on vacations, which is an area that was previously experiencing a boom as consumers wanted to get away from their homes once the pandemic restrictions were lifted. That makes sense, after all, it did feel like we were all couped up for the better part of two years and a chance to get away is welcome. We saw this in the fact that Friday, June 30, 2023 (right before the Fourth of July weekend) was the busiest day in U.S. aviation history. As just mentioned though, some consumers are showing signs of cutting back as Flix North America, which owns the Greyhound and Flix bus lines, reported that bookings were up 70% year-over-year over Memorial Day weekend and 63% year-over-year over the Fourth of July weekend. There were no reasons provided for this, but it could be a sign that some consumers are opting to take the bus instead of flying or driving to save money. While this is admittedly not nearly as conclusive evidence of a strapped consumer as the credit card data, it still points to a growing number of people hurting financially in the current environment.

Market Ignorance

Meanwhile, the market continues to show ignorance of the growing stress of the American consumer, which accounts for about 70% of all economic activity in the nation. As of the time of writing, the S&P 500 Index (SPY) is up 18.92% year-to-date:

The market appears to be pricing in phenomenal economic growth despite the fact that most of the evidence points to the largest economic engine in the nation weakening over the same period. This is not sustainable and at some point, we could very easily see the market crash back down to reality.

Stay safe out there.

Disclosure: I have no positions in any securities mentioned as of the time of writing and have no plans to acquire a position within the next 72 hours.