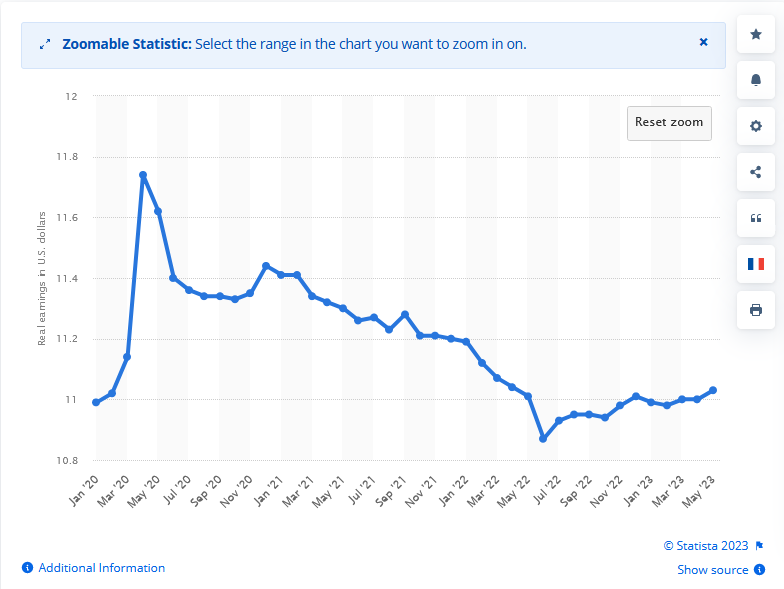

Over the past several months, I have been discussing how American consumers are experiencing considerable financial stress today. This should be fairly evident by looking at real wages, which are the average wages earned by consumers after adjusting for inflation. In May 2023 (the most recent month for which data is available), real hourly wages in the United States were $11.03, compared to $11.41 in January 2021. Real hourly wages peaked back in April 2020 and have generally been declining since then:

We do see that this figure has improved a bit since June 2022 but this fails to take average hours worked into account. As Zero Hedge is keen to remind us frequently, real earnings were down for 26 straight months as of the most recent jobs report. This has naturally made people desperately search for ways to increase their incomes in order to cover the rapidly increasing costs of living in the United States today. As I have pointed out before, a recent Prudential Pulse survey states that roughly 81% of Generation Z members and 77% of Millennials are either taking on second jobs or entering the gig economy just to obtain the extra income that they need to maintain their standard of living. It is hard to believe that we would be seeing such numbers unless people were truly desperate.

The Problems Keep Getting Worse And Worse

I have discussed the problems facing consumers in numerous previous posts on this blog. For example, see the following articles:

- The U.S. Consumer Is Hitting A Brick Wall, Negatively Impacting Discretionary Stocks

- The U.S. Consumer Continues To Get Crushed

- Student Loans To Deliver Another Blow To Consumer Spending

Despite the fact that the inflation report this morning showed the lowest year-over-year increase that we have seen since the pandemic, there are still numerous signs that things are not getting any better for consumers. After all, one thing that people tend to ignore is that inflation compounds just like stocks, so a decline in inflation does not actually improve the standard of living for anyone unless inflation actually goes negative. The headline 3.0% year-over-year number today was still higher than the Federal Reserve target and it comes on top of a 9.1% year-over-year increase in June 2022 so due to compounding prices are still substantially higher than they were during the pandemic or prior to it.

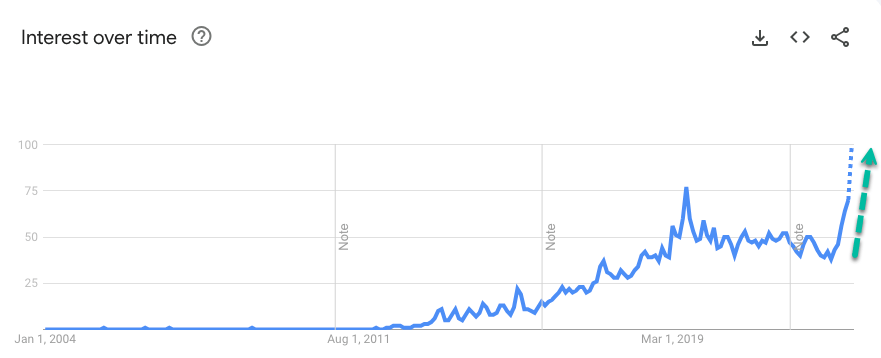

As just mentioned, this has caused consumers to take actions that may have been unthinkable just a few years ago. For example, as I pointed out in a recent article on Seeking Alpha, Google Trends data is showing a steep increase in the number of people searching for “pawn shops near me” or something similar:

This is a sign that people may be looking to sell unneeded items in exchange for cash. A lot of people have a certain amount of pride in their ability to support themselves and are unlikely to be seriously considering pawning possessions unless they are truly desperate for cash.

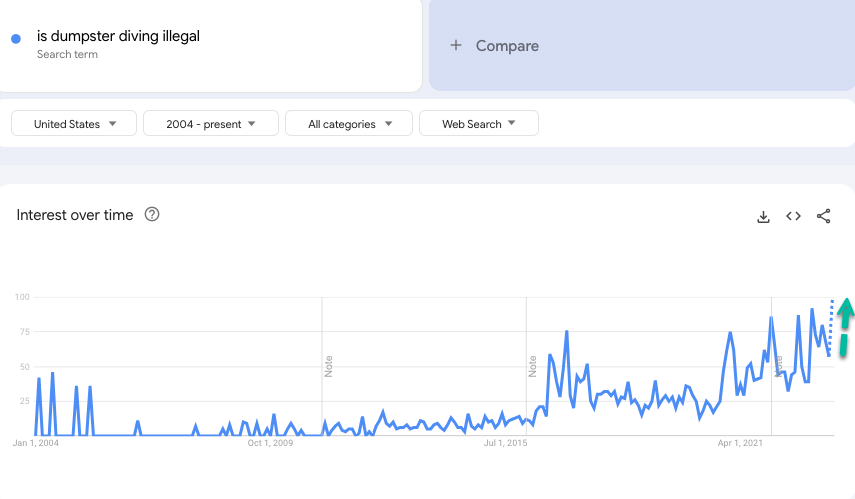

Some people have gone even further than pawning their possessions. Business Insider recently reported that some Millennials have resorted to dumpster diving in order to save money on groceries. The New York Post had a similar article. Ordinarily, I would dismiss this as just something that a very small handful of people are doing, and such things occur even during good economic times. However, Google Trends shows that searches for “is dumpster diving illegal” have increased in recent months:

Thus, it appears that a growing number of people are seriously resorting to going through others’ garbage just to obtain food. It seems very, very unlikely that this would be happening unless a substantial number of people were having difficulty covering their bills in the face of the worst inflation that we have seen in forty years.

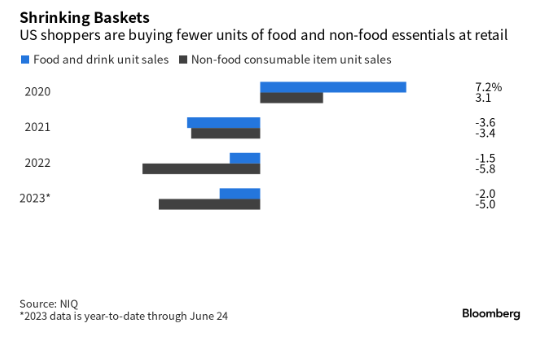

Another sign that consumers are having serious difficulty paying their bills comes from NIQ, which recently revealed that consumers are actually cutting back on personal hygiene products such as toilet paper, toothpaste, and laundry detergent:

The prices for these items have certainly not been declining so we cannot explain this trend in that way. It is possible that some of this can be explained by people trading down for cheaper consumer products, but there are probably also people that are opting to go without these things. I have a very hard time believing that anyone would go without toothpaste or toilet paper unless they were in absolutely desperate financial straits. This is therefore almost certainly another sign that the U.S. consumer is getting crushed by the current economy.

Market Not Reflecting The Weak Consumer

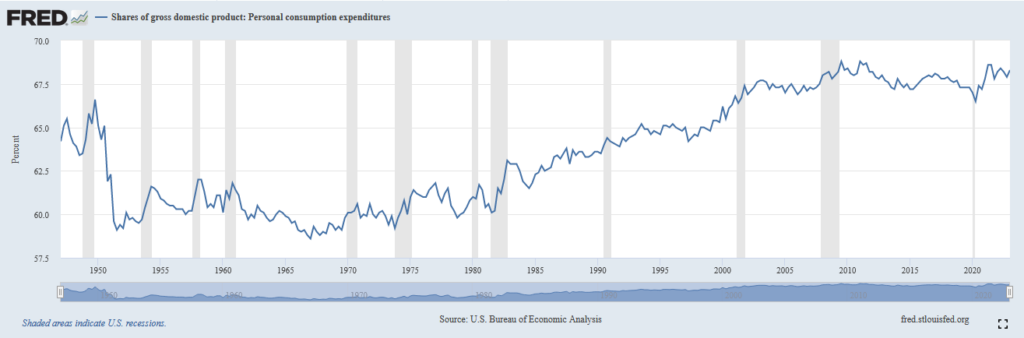

It is a commonly known fact that the United States economy is based on the ability of the consumer sector to spend money. According to the Federal Reserve, consumer spending accounts for 65% to 70% of gross domestic product. The last time consumer spending was less than 60% of gross domestic product was the fourth quarter of 1978:

Thus, investors should pay a great deal of attention to U.S. consumer spending trends as it accounts for an outsized percentage of real economic performance. The fact that the U.S. consumer seems to be getting increasingly weak is thus a very big headwind for U.S. economic performance.

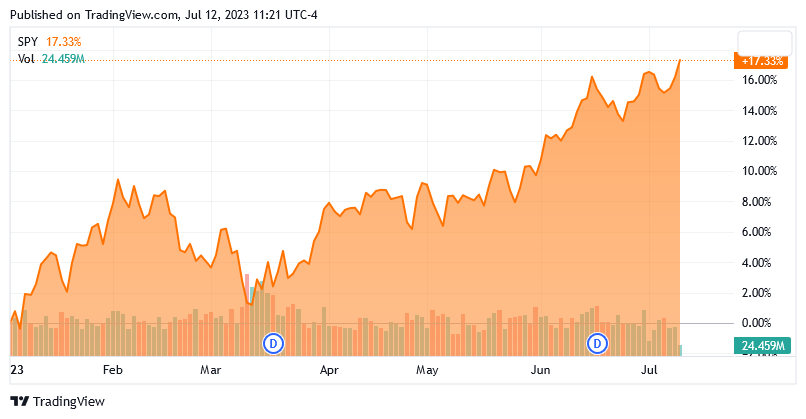

The stock market seems to be ignoring this completely. The S&P 500 Index, as measured by the SPDR S&P 500 ETF Trust (SPY), is up 17.32% year-to-date:

This makes no real sense considering that the largest driver of corporate profits in the United States appears to be under a substantial amount of financial stress. There are many analysts saying that the current run-up is a sign that the market expects that interest rates will be reduced. That will cause money to flood into the stock market and push up asset prices, just like it did during the 2010s and in 2021. While that would probably happen if the Federal Reserve does cut rates, which it claims it won’t, ultimately stock prices still have to reflect the performance of the economy and each individual company in the economy. When the largest segment of the economy is under considerable financial stress, it is hard to believe that companies will be growing their profits at a rate that justifies the significant run-up.

Conclusion

In conclusion, the consumer sector is the largest component of the American economy, and it appears to be under considerable stress. This will undoubtedly have adverse impacts on the profits of those companies that are exposed to American consumer spending, which is most of them. The market appears to believe that corporate profits will skyrocket in an environment in which millions of average people are struggling to feed themselves. This is something that should be very concerning as ultimately the market has to reflect the actual performance of the component companies, so there are substantial downside risks here that everyone seems to be ignoring.