Over the past few months, I have been writing about how the jobs market has been somewhat resilient despite the fact that there are numerous signs of economic weakening. We are now finally starting to see job numbers pointing to an impending recession.

ADP And BLS Data

The first recent data point comes from Automatic Data Processing, which publishes its own monthly jobs report alongside the official government jobs report issued by the Bureau of Labor Statistics. Investopedia describes the ADP jobs report thusly,

“The ADP National Employment Report is a monthly report of economic data that tracks the level of nonfarm private employment in the U.S. It is published by Automatic Data Processing, a company that handles payroll for about a fifth of all privately-employed individuals in the U.S. The ADP National Employment Report is also known as the ADP Jobs Report or the ADP Employment Report.”

Investopedia

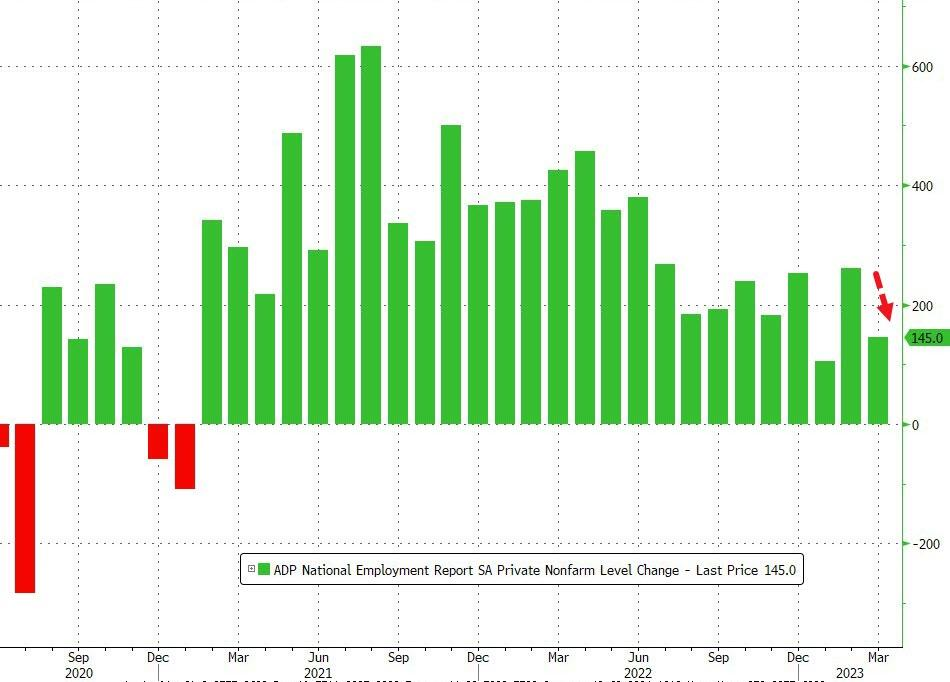

On Wednesday, April 5, 2023, the ADP Jobs Report for the month of March was released and it was terrible, to put it mildly. The report showed that far fewer jobs were created in March than were in February:

The report also greatly missed the expectations of analysts. There were other signs that the jobs market is weakening too, which Zero Hedge noted in its analysis of this report. In particular, we see the following things in this report:

- Pay growth is decelerating. This is a sign that the job market is no longer as tight as it was a few months ago and that the demand for workers is weakening.

- Manufacturing and financial services showed the greatest number of job losses. This is not particularly surprising considering that the macroeconomic data for the manufacturing sector has been showing signs of weakness for several months and the recent troubles with bank collapses will naturally kill jobs there. It is worth noting too that the manufacturing sector usually slows down before a recession.

- Women’s wage gains are outpacing men’s in every sector.

- Leisure and hospitality shows the greatest wage gains, but even these are slowing down month-over-month. The fact is that the greatest amount of strength in the jobs market over the past two years has been in leisure and hospitality, with some dubbing this a “waiters’ and bartenders’ market.” It appears that this is still the case.

The official jobs report from the Bureau of Labor Statistics was released on Friday, April 7, 2023. It showed some of the same things that the ADP report did. In particular, we see that job growth slowed considerably in March:

This further reinforces that a recession could soon be hitting the United States. The official jobs report has been accused of being somewhat political lately as these reports have been showing a much stronger narrative than just about every economic report published by non-government sources. I have weighed in on this before. We can still see this here, but it appears that the government agency was unable to spin the data in a favorable way as the March 2023 print was the worst that we have seen since December 2020. As some of you may recall, there were several states that locked down restaurants and similar businesses during December of that month due to fears of COVID-19 spreading. In some ways, that reinforces the fact that the jobs market strength appears to be driven by low-paying leisure and hospitality jobs as opposed to the high-paying jobs that can actually support a family.

Interestingly, the official jobs report showed a decline in wage growth. According to the agency, nominal wages increased by just 4.2% in March, which was lower than the expected 4.3%:

It is critical to note that with inflation running at 6% annually, this represents the 23rd straight month of real wage declines. This explains quite clearly why we have seen an uptick in both gig economy work and part-time second job holders, as people are desperate to maintain their standard of living despite rising prices. I have mentioned this in numerous previous articles.

For the most part, the remaining items that we saw in the official job report are somewhat rosier than the ADP numbers, but they show the same trends. In short, job growth and real wage growth are slowing down. This clearly shows that the labor market is loosening up from its previous tightness. When combined with other data, we are seeing clear signs that a recession could be on the horizon.

Tech Sector Layoffs

As I mentioned in my previous article about the job market, the technology sector has been a major source of layoffs this year. This is in stark contrast to back in 2020 when the sector was literally hiring people with the expectation that it may have work for them in the future. According to layoffs.fyi, there have been 168,918 people laid off from 570 technology companies this year. That comes on the heels of 164,411 people laid off by 1,054 technology companies last year. When we consider the things that we are seeing in both the ADP report and the BLS jobs report, it seems unlikely that these people will be easily able to find new work at anywhere close to the wages that they were receiving in the technology sector. Thus, this is another group of consumers that could be finding itself very financially squeezed by the current economy, which ultimately will result in problems making discretionary purchases, which is already a problem across the nation.

Conclusion

Overall, we are seeing more and more signs of an economic slowdown with each passing day. This is exactly what the Federal Reserve has been attempting to engineer with its rate hikes, but the official jobs report is still too strong for a pivot. Chairman Powell has said as much and recently reinforced the fact that the Federal Reserve will not pivot in the near future. Despite this, the stock market continues to be optimistic that the economy will surge upward by the middle of the year. This seems to be less and less likely and that could result in problems for anyone buying highly-speculative stocks today.