It seems as if some sector of the economy is in a perpetual bubble, or perhaps the markets are always in a mania. After all, for most of this century, there has been some asset that investors are buying simply because there is a fear of missing out with no consideration for value. For example, consider all of the following things:

- The technology bubble of the late 1990s saw pretty much anything with “.com” in its name skyrocket in value. This was true even for companies that had no revenue. Of these companies, pretty much only Amazon.com (AMZN) grew in its valuation. Alphabet (GOOG) came after this period. Nearly all the rest of the companies that achieved high valuations during this period are gone.

- The real estate bubble that emerged quickly after the technology bubble ended. There was a surge in people purchasing houses just to flip them. It was profitable because of how quickly real estate was gaining in value. This ultimately resulted in the worst recession that the nation has experienced since the 1930s.

- A traditional energy bubble that lasted from 2010 to 2013. This period saw some of the highest inflation-adjusted crude oil prices in history. We saw offshore drilling companies like Seadrill (SDRL) borrow considerable amounts of money to rapidly build drilling rigs while still paying out a high yield to investors. This was ultimately killed when the Saudis deliberately oversupplied the market with crude oil in a bid to crush American shale. The offshore drillers have still not recovered.

- The “everything bubble” that lasted from 2010 until 2020 saw the market valuations of just about everything shoot up much faster than the gross domestic product. It was brought to a temporary lull in 2020 but resumed shortly thereafter. It arguably ended in 2022 when the Federal Reserve finally got serious about stopping inflation.

This leads us to today, in which we have a market mania surrounding anything related to Artificial Intelligence. While it certainly appears to be a bubble to me, I am hesitant to officially call it one until we see exactly how everything plays out.

The Split In The Market

One of the curious things about the mania surrounding artificial intelligence is the split that it has caused in the market. After all, we have been hearing about an impending recession all year. Indeed, most economists expect that a recession will hit during the second half of 2023, and every major indicator of economic performance other than consumer spending points to this. Despite all of these fears, the S&P 500 Index (SPY) is up 14.32% year-to-date:

This is confusing as it appears that the market action has no actual basis in economic reality. However, it begins to make sense when we consider the artificial intelligence mania.

There are seven companies that are generally considered to be among the leaders in the deployment and use of artificial intelligence:

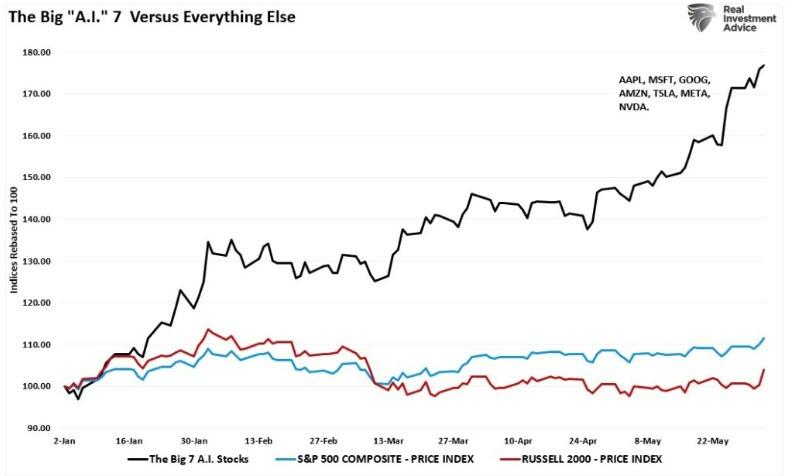

Take a look at the year-to-date performance of these seven stocks against the S&P 500 Composite Index and the Russell 2000 (IWM):

These seven stocks account for a substantial weighting in the S&P 500 Index. I pointed this out in an article published on Seeking Alpha back in 2020. As the S&P 500 Index is a market cap-weighted index, companies with a higher market cap are assigned a higher weighting. Over time, this can result in a few stocks effectively controlling the index. This is exactly what is happening today, which we can see above. Doug Kass recently stated this rather succinctly:

Taken in a broader context, over 100% of all gains this year in the S&P 500 Index have been driven by seven stocks. Three of those seven stocks account for 68% of the S&P 500’s entire yearly gains. Year-to-date, the unweighted S&P 500 Index has climbed by 9.1%, thanks to a 30% rise in technology, while the Russell Index is -1.0% and the equal-weighted S&P 500 Index is -1.1% lower.

In other words, pretty much the entire market is reflecting a weakening economy, which is in line with the views of economists and most of the data. All of the gains this year have been due to just seven stocks that are all from the same sector. As I noted in a previous blog post, the valuation of several of these stocks is at astronomical levels and has only gotten worse over the past month since I made that original post. Thus, it clearly appears that not only does the S&P 500 Index not represent the actual state of the American economy but it is not even a well-diversified measure of the market as a whole!

Disclosure: I am long S&P 500 index funds as well as the NASDAQ 100 composite and various AI-related funds as of the time of writing.